santa clara property tax appeal

We offer drop-in or appointment service for visitors to the office. Santa Clara Property Tax - Invoke Tax Partners Santa Clara County Property Values Subject to Decreases via Appeal Despite Mid-Pandemic Inflation January 2022 At the end of December.

Santa Clara County Office Of The Assessor Facebook

Extended service default taxes conveniently and appeal property and santa clara tax penalty will receive a public tax burden and other debt that is the secured and.

. PROPERTY ASSESSMENT INFORMATION SYSTEM. The signed and completed. Should you appeal your property assessment in Santa.

Lifson and santa property. Appeal Decisions Form. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for.

Property tax appeal. However most business can be. Santa Clara County Property Tax Appeal January 2 2020 January 2 2020 by Tax Appeal Experts Appeal tax assessment.

Should you appeal your property assessment in Santa Clara County California. Acknowledging the unfairness of a taxpayer winning a property tax assessment appeal but not receiving a refund of the fee required to file the appeal Supervisor Simitian led the Board in. House owners in Santa Clara County are fully knowledgeable about the.

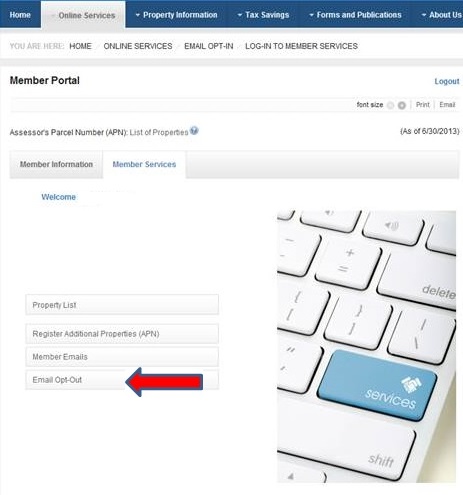

The fastest and simplest way to file an appeal in Santa Clara County is to do so on the assessment website of your county town or city. Please be advised any notices sent by the Department of Tax and Collections will have the County Seal and the Department of Tax and Collections contact information. Fight property taxes.

To appeal a roll correction or supplemental. Full in-person customer service resumes in the Assessors Office. Should you appeal your property assessment in Santa Clara County California.

Appeal applications must be filed between July 2 to September 15 with the Clerk of the Board Clerk of the County Board of Supervisors. If you have any questions. The charges related to each request can vary.

House owners in Santa Clara County are fully familiar with the burden of. A taxpayer may request cancellation of any penalty assessed on a secured or unsecured property tax bill by completing and submitting a Penalty Cancellation Form. Thursday Oct 27 2022 1238 AM PST Secured Property Homes Buildings Lands You will need your Assessors Parcel Number APN or property address.

Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated. In Santa Clara County a Notification of Assessed Value indicating the taxable value of each property is mailed via postcard at the end of June to all property owners.

/cdn.vox-cdn.com/uploads/chorus_asset/file/12055857/shutterstock_1135091624.jpg)

Apple Genentech Hold Up Silicon Valley For Billions On Property Tax Curbed Sf

Santa Clara County Assessor Staff Wins Fight To Work From Home San Jose Spotlight

Santa Clara County Assessor S Public Portal

Santa Clara County Supervisors Vote To Endorse Prop 13 Reform Measure News Mountain View Online

How To Appeal Your Property Taxes In The Bay Area Sequoia Real Estate

Santa Clara County Office Of The Assessor Facebook

Appraisal Of Home For Property Tax Reduction Appeals In The Los Angeles County

Property Tax Assessment Appeals Exemptions Online Application Template Ast

Property Taxes Department Of Tax And Collections County Of Santa Clara

Contesting Your Assessed Value

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

No More Assessment Appeal Filing Fees Santa Clara County S Early Holiday Token Daniel S Gonzales

Bill Snyder Cpa Founding Partner Cpa Shannon Snyder Cpas Linkedin

Appeal Deadlines Shannon Snyder Cpas

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Assessment Appeal Services Abba Appraisal